*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

Are you hoping to find tips on how to manage money when unemployed? Maybe your under-employed and need tips on managing your lower cash flow. You’re not alone.

In this article we’ll show you

- How to check for eligibility of unemployment payments as well as other services they offer.

- We’ll also go over other resources that can help you.

- We’ll cover all you need to know about how to budget when unemployed.

- And finally, we will talk about if you are allowed to earn while collecting and if this will make you ineligible.

- Followed up with ways you can make money soon.

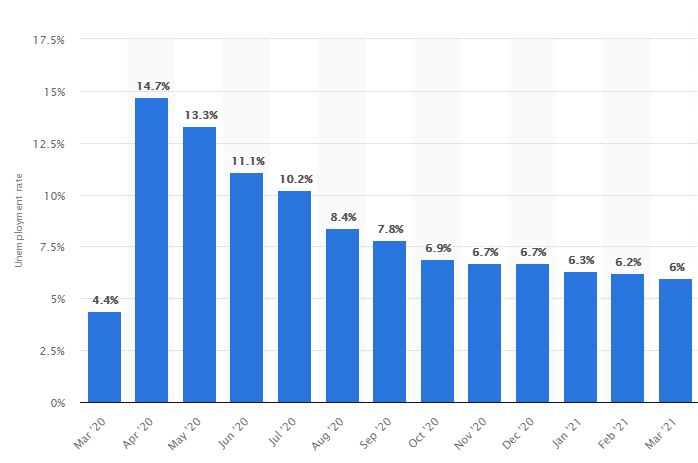

As of the date of this article the US statistics on unemployment and poverty, while high at 6%, are showing positive progress in the trend! This data gives hope that you will have employment options and opportunities in your future.

Tips On How To Budget & Manage Your Money When Unemployed

Chances are you came upon this article because you’ve recently found yourself out of work. Maybe you haven’t worked in a while and the ‘financial pinch’ is starting to hurt.

Or like so many today, you are worried about losing your job and want to be armed with the knowledge of how a budget for an unemployed person is different from an employed budget.

First, you are NOT alone! We’ll walk through this together. Learning how to manage your money when unemployed isn’t always fun. I think you’ll agree though, it’s necessary.

Stick with me here. I’ll try to keep your stress low and we’ll find some unique ways for your budget for unemployed status. Heck, we’ll even give you tips for getting through to unemployment for applying, career education and search, healthcare questions, and general support systems.

Let’s first go through some of the basics and dig into where together we can find ways to get through this tough time in your life. First up is to give some thought to how to budget and manage your money when unemployed, whether it lasts 2 weeks or several months.

We’ll even cover tips on how to get through to unemployment and benefits to ask for guidance on.

Before we go much further. I wanted to be sure you know I hear you. It’s hard and scary. I’ve been there. My family has been there. I’ve gained some valuable perspective not only from my experiences but from others as well. Let’s take the scary out of it and confront those fears head-on, together.

What Is A Budget And What Is The Purpose Of A Budget?

A budget is the most important part of how to manage your money when unemployed. Budgeting for being unemployed is a plan for your future income and spending. Without it, you may overestimate your current income or underestimate the number of expenses you have. For example, if you only receive $300 in a month but spend $500, the money will run out quickly and be gone before you know it.

With more money than people actually have coming in across the country nowadays (due to sky-high housing costs, especially rent), without careful planning, lack of financial planning could lead to massive debt and even bankruptcy.

The purpose of a budget is to help understand where the money comes from and how much is available at any given moment. This is so that later on, impulse purchases can be avoided, thus creating a debt cycle over and over again.

How Do You Make A Budget?

It’s not possible for a one-size-fits-all answer to cover every situation. No more is it possible for a one-size to fit every person.

Different people have different income levels, spending habits, and savings goals. This is why most financial advisors recommend some form of budgeting as a key first step in improving your finances.

This allows you to make decisions that will work best with your current circumstance rather than randomly guessing what might be good. Meaning a budget can help you during times of financial success and when struggling through a lower income when you’re learning how to manage money when unemployed.

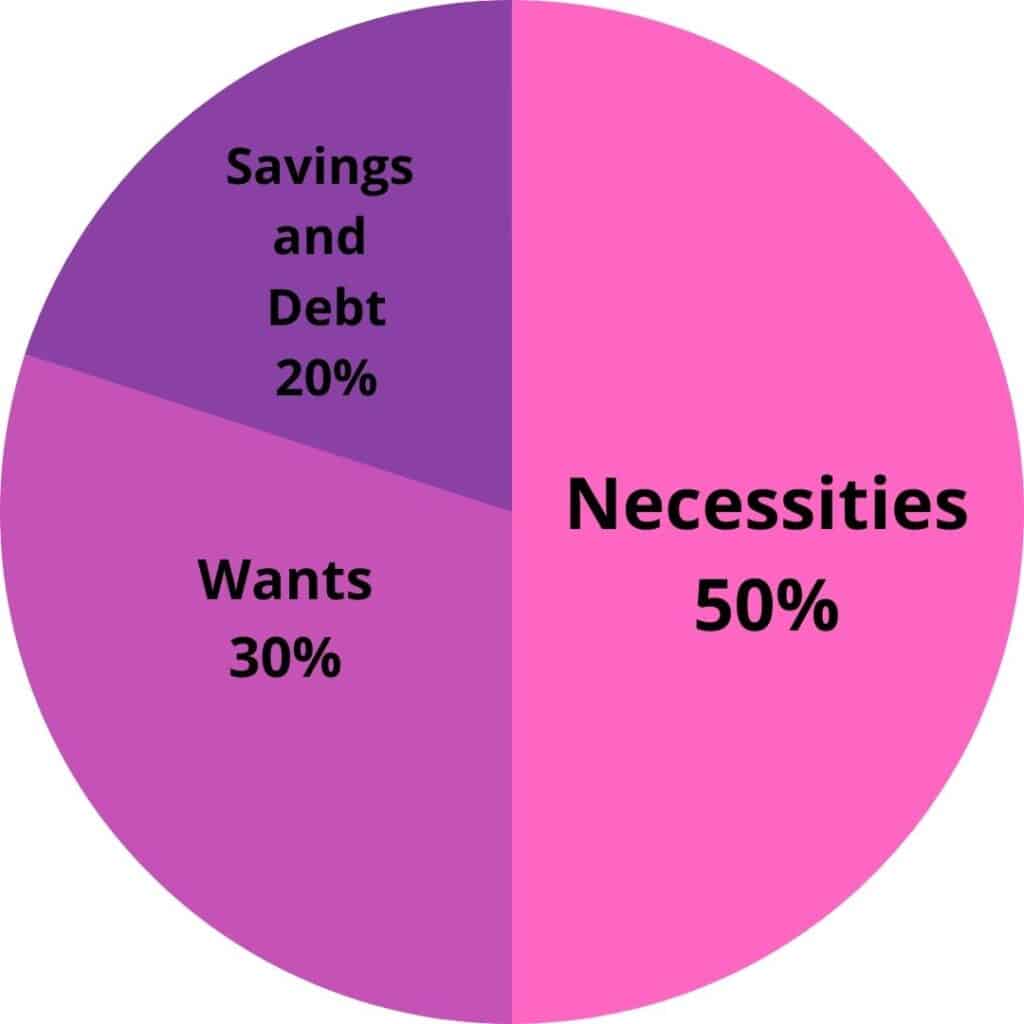

One widely used and general tip is something called the 50/30/20 plan which recommends having 50% of your take home pay go towards necessary monthly expenses (housing, utilities and groceries); 30% put into a savings account where you stash money on the side for things like vacations. 20% gets put directy into debt and savings.

How Do You Budget If You Are Unemployed

If you’ve recently lost your job, let’s be real. It’s challenging to think about what needs to happen in order for you not fall behind on bills and other financial responsibilities. However, with the right tools and a sensible, down to earth approach to expenses (like keeping an updated budget), there are many ways that will allow you stay in control when it comes to managing finances while unemployed.

The rules are the same. You go through your budget, look at your ‘new’ income. Next Up look at ALL your spending, not just expenses. Highlight or list in seperate column, your ‘must pay’

| INCOME | NECESSITIES | WANTS | DEBT/SAVINGS |

|---|---|---|---|

Start acting like a ‘boss’ and cut out the regular spending items like take out coffee, lunches. Open your grocery store flier and ONLY buy what you need and ONLY if it’s on sale. Go through each and every item on the list as if it’s unique and make cuts or calls to see where you can reduce expenses.

Do I Need To Get Professional Help To Manage My Money?

That is a solely personal decision. Honestly, paying anyone right now while your trying to find a budget for unemployed status is a hard one. I’d first sit down and see how you do for yourself. If there is a person you inexplicably trust then ask them to help. A financial planner is one of the best tools you’ll have in your life, but someone who tells you they can manage your money through unemployment should be carefully scrutinized and vetted.

There is however FREE help in the form of apps and desktop record keeping. There are some reputable resources below, however you should still do research yourself to find the best fit.

Are There Apps That Help You Manage Your Money?

One of the tools to help you learn how to manage money when unemployed is an app or online program. There are many out there. Below are only a few. Find what works for your level of tech-savvy and available devices.

- Mint

- Acorns

- Credit Karma

- Others would be your local bank. Many local banking institutions now offer free bill pay and budgeting programs online.

Other Tools To Help Budget Your Money When Unemployed

It can be really difficult to balance a budget when you’re unemployed. You may have already been living paycheck to paycheck, which means that now you don’t even know where your next meal is coming from. If this sounds like you, then read on for some helpful resources on how to start budgeting and managing your money to survive without a job.

Unemployment Insurance

Unemployment insurance is paid by your employer by law in the event of a layoff or job termination that is due to no circumstances you (the employee) could have prevented. There is a list of criteria that must be met to qualify for this:

- Unemployed through no fault of your own and

- Worked during a specified period, usually up to 18 months, and

- Earned a minimum amount of wages as determined by each state, and

- Actively seeking work each week you are collecting benefits.

Eligibility checker and contact information can be found here for your area.

Disaster Unemployment Assistance

The Disaster Unemployment Assistance (DUA) program provides unemployment benefits to individuals who have become unemployed as a direct result of a Presidentially declared major disaster. DUA is an extension of the traditional state-run UI system designed specifically for those in areas that are impacted by natural disasters or other causes beyond their control.

To be qualified for this benefit, your employment or self-employment must have been lost or interrupted as a direct result of a major disaster declared by the President. You won’t be eligible if you’re receiving regular unemployment insurance benefits (under any law).

- No longer has a job.

- Is unable to reach their place of work.

- Cannot work due to damage to the place of work.

- Becomes the head of the household and is seeking work because the former head of the household died as a result of the disaster.

- Cannot work because of a disaster-incurred injury.

Contact your State’s Unemployment Agency to see if you qualify. Numbers can be found here by clicking the dropdown box and choosing your state.

(source: benefits.gov)

Disability Benefits

The Social Security and Supplemental Security Income disability programs provide assistance to people. Before you apply, take time to review the basics; understand the process of applying for these benefits; and gather any information or documents needed in order complete an application with ease.

Social Security pays only for total disability.

You are considered disabled under Social Security rules if all of the following are true:

- You cannot do work that you did before because of your medical condition.

- You cannot adjust to other work because of your medical condition.

- Your disability has lasted or is expected to last for at least one year or to result in death.

source: SSA.Gov

Employment Assistance ~ Help Finding A Job

Unemployment Assistance will provide you with resources for job search, skills training and coaching on resume building. You do NOT need to be collecting an unemployment payment to be eligible. There are a large amount of resources available to anyone unemployed that meets eligibility. These range from hands on training and workshops to online resources.

American job centers offer a range of free services to job seekers including training, career planning, and connections to jobs openings all over the country. The Job Centers are conveniently located with nearly 2,500 locations nationwide for easy access.

Use Career and Job resources like Monster and Indeed who offer pretty much all you need to find work or research new careers. They are so much more than job finding website. You’ll find salary comparisons, benefits information, resume resources, and a lot more.

Tere Stouffer

Used correctly, a budget doesn’t restrict you; it empowers you.

10 Tips On How To Budget And Manage Your Money While Your Unemployed

Look, there’s no denying it, we’d all like to win the big ticket and live debt free and worry free from financial responsibilities. That’s just not going to happen for most of us. Here we are. Looking at a huge loss in our regular income and wanting to be sure we can move forward while not losing much more.

The best way to manage money when unemployed is to stick to the basics. Live your best life with the resources available to you and strive towards a new job. There are tips that can help you achieve these easier, so let’s look at those to help you through.

Great Read: Stop Living Paycheck to Paycheck

1. Understand Where You Money Goes Each Month; List All Expenses

While you’re preparing your new budget for unemployed status stop spending. Take a breath, this is just to get through the budget process. Below we have step-by-step tips to manage money when unemployed. Keep scrolling.

We talked about this above. List all your expenses. Each and every one of them. Write them down.

2. List All Of Your Available Income Sources And Assets

An Asset is containing economic value and/or future benefit. Let’s start with Cash available for your Assets. For this section you’ll list

- Savings

- Checking

- Income from side hustle

- Severance Pay (if given)

- Vacation Pay due you (if available)

- Monthly support payments you receive

- Rental income

- Any money owed you by others

- Other incoming cash

note: For future purposes you should still keep a running list of all assets such as home, car, property (values if sold), etc..

3. Determine The Amount Of Money Needed Per Month While Unemployed

List all your expenses. ALL of them. You can do this by going though your debit card statement(s), checking account, savings account and receiptes, credit cards, etc.. Put that great big pile of papers on your table and start listing them out. Don’t be shy, I saw that candy bar!! Was that your torn up lottery ticket in the trash?

I know, I mention this part, listing your expenses often. Broken record? Maybe. I am looking to be sure you have looked once, twice then looked again. In order to budget for unemployed life you need to be more realistic than you may have ever been before.

4 Review Your Bank And Credit Card Statements For Automatic Payments

(People forget about charges and subscriptions services. Cancel all unnecessary services at least temporarily)

Dig them out, print them out. Review ALL your bank and credit card statements for automatic payments. Look at that PayPal account too! Do you have regular subscriptions or donations you make that are set up for auto-pay? Go through these and scrutinize with great care. You need to cut some of these out. In all honesty, you probably have wanted to anyway, so let’s get it done now.

Now go back to your list of ALL expenses and cross off the ones you’ve just cancelled.

5. Immediately Halt Any Non-essential Expenditures

What is a non-essential expanse? This will vary by your spending habits. These are things you don’t need to spend money on now, they don’t keep a roof over your head nor do they feed you. Examples are: new clothing, books, movies, magazines, video games, dining out, gifts, snacks, candy, shoes, most cable channels, etc

If you are serious about creating a budget when unemployed you need to get serious about cutting out the non-essentials too.

Once you’ve done this, go back to you list of expenses and adjust or cross out these as well.

6. Thoroughly Check Into Local, County, And State Services And Assistance Programs

(any assistance with food, utilities, and sometimes transportation or career services from relief agencies should be used–that is what they are there for…Including food banks, church programs for Christmas, etc)

Whether you think you need additional help or not, you need to be prepared. Find out and write down all your local services and assistance programs. As you go through the processs, you’ll find people will be helpful and let you know if they’re aware of even more than you think to ask about.

Some of the programs you want to be aware of are: Food pantries, clothing exchanges, sports equipment exchanges (for kids), gift assistance, utilitie assistance (remember to also ask your utility company).

Places that administer these programs and resources are Churches (and you don’t always need to be a member of their church), senior centers, town halls, town nurses, schools, other local community organizations (keep your eyes out, they’re everywhere). Some of these you may not have noticed in the past but you’ll be hyper-aware now that you have a potential future need.

These places will often know of other resources available. You need only ask if they know of any other assistance programs that could help you or your family during this time.

You’re not alone, you don’t need to feel too proud for assistance. We all fall on hard times at times in our life in different ways. Remember, this is temporary. To manage your money when unemployed also means budgeting your resources.

7. Avoid Using Your Savings And Emergency Fund (If You Have One) As Long As Possible

We know by now that being unemployed is most likely unexpected and unplanned. However, you need to refrain from using your savings and emergency funds for as long as possible. Part of the unknown is not knowing exactly when you will return to a full time employed job and if you’ll need to take a temporary pay cut. These emergency funds need to stay put for as long as absolutely possible.

8. Spend Time Investigating Free Activities In Your Area

(Not just recreational, maybe volunteering, which could lead to employment or odd jobs as well.)

Volunteer your time and experience to others. Look for local community projects or organizations that need help. The more you socialize and network the better. This is a great way to keep your mind and hands busy. This also offers huge benefits to keeping your morale up while looking for a new job too.

Chances are you’ll gain a few new skills and meet someone in the same boat as yourself. There are power in numbers and the old saying ‘it is in giving we receive’ holds a lot of truth!

Take walks in your area. Get to know neighborhoods and areas you didn’t have time to explore before. Keep your health and emotional well-being in check. It’s harder to stay positive if you stay hunkered inside by yourself all day. You may see a neighbor who has a day off, start a conversation only to find out their company is hiring. Who knows? But you’ll never know if you don’t try.

Must Read: Try The No Spend Challenge

9. Learn From Managing Money When Unemployed To Be Prepared For Next Time

Hopefully, the next time won’t happen. Get out and stay out of debt, save money, make your Emergency Fund a priority, keep non-essential spending habits at bay, and to budgeted only.

In the future, budget money to spend on entertainment and indulgence with care and purpose.

Lisa Conway-Hughes

The secret to budgeting is that it needs to be honest. Not what you think it should be or wish it could be, but what it really is.

10. Getting Through Unemployment, The Four Corners

A lot of financial experts recommend always taking care of the four main essential needs first, any money left over can go towards other things

- Food-everyone needs to eat

- Utilities-electricity, water & heat***

- Lodging-keeping a roof over your head

- Transportation-to get to work**

Leftover money should be put towards a list of other expenses in rank of priority. Pay bills in order of priority.

**If you aren’t commuting to work, call your auto insurance company and see if you can negotiate for a reduction in rates due to decreased mileage. If you aren’t traveling at all or have two cars, “garage” one. Insurance rates are usually 90% discounted for a vehicle that isn’t currently being driven. You can call and be able to drive the same day, or at most 24 hours to reinstate previous coverage.

***If you haven’t done so already, find out from your utility company if they can put you on a budget plan. Also, request a free virtual or in home energy audit.

Finding Temporary Solutions To A Long Term Cash Flow Problem:

Can you work when collecting unemployment insurance payments? Yes. Check with your unemployment office and find out the specifics. You want to know how much you can make before it impacts your monetary benefit. You also want to know how much you can make before losing benefits. A temporary job is a great thing but if it has any weight the only regular income you have, you want to be fully informed.

Food Delivery Drivers Are In High Demand

- Uber Eats

- DoorDash

- GrubHub

- InstaCart

- Other: check your local grocery stores, they often have their own in-house staff.

Check Gig Options And Online Work From Home

It’s a whole big world out there. Don’t limit yourself to traditional only job searches and income opportunities. Many people are making a decent living doing multiple jobs at any given time. These are great, quick money opportunities, however keep your options open when considering any potential longer term or multiple income streams. This could be the ‘new employed’ you.

- TaskRabbit

- Thumbtack

- Fiverr

- Network with local small businesses for ‘one-time’ tasks/projects they may need help with.

- Other: post in Craigs List, FB Market Place, Local towns have ‘recommends’ pages on Facebook also.

Rent Out A Room, Get A Roommate or Rent Another Space

Consider renting your spare bedroom. Feeling funny about having a stranger in your home? Rent out your basement for storage, your garage, even an open area of your yard for gardening.

Have a Yard sale Or Use Online Services Like eBay

Clean out that clutter in the basement, closet, etc. List on local yard sales, sell on eBay, give away. Uncluttered space is an uncluttered mind. Clean up that wooden rocker you never use.

Get some stress relief by using up some creative energy. Once it’s all painted nice and looking all fancy and brand new, flip it for a profit! Sometimes an old bureau only needs the hardware to be replaced, or even better, shined up for a higher price tag.

Everyone and everything has potential and you have some time now and a really good reason to make it happen.

Offer Pet or Home Sitting

Let your friends and neighbors know you are looking to stretch your budget while unemployed and are available to help with any home-sitting, pet walking, or other pet sitting needs they may have. Maybe they just need someone to drive their new puppy to the vet or groomers.

Are your friends planning a vacation and need someone to tend to water the garden, house plants? Check the mail? Shovel the walk if it’s winter? There are countless reasons to pay others a few dollars here and there to make their lives easier. You could help them out and make a few dollars in the meantime.

Get the word out. With the recent increase in dog owners, this has potential for a great side hustle turned small business too!

Maintain and Leverage Yourself On Social Media.

Are you a social media socialite? Have a large following? Influencer companies like this one at Sivan are always looking for new influencers (people with large engaged audiences) to help them get the word out.

Bonus:

While your learning how to manage money when unemployed you could be applying these same skills to learning to manage your money as a new small business owner.

Jae K. Shim

Budgeting allocates funds to achieve desired outcomes.

Common Questions

Where Do People Keep Their Emergency Fund?

Surprisingly, many people still use traditional low interest savings accounts. Shop around for better rates. Credit unions and online banks tend to be more competetive. If you’ve reached your 3-6 month emergency fund goal also consider these options: CD’s (certificate of deposit) , Money Market Accounts, IRA’s. Talk with your financial provider for guidance.

Do I Have to Pay Taxes on Unemployment Benefits?

You sure do! Unemployment Insurance Benefits allow for up to 15% of automatic deduction for taxes. However, as a rule you should put aside minimum of 25% of your Gross (pre-tax) unemployment benefit. Set aside a new savings account for the additional 10%. Nothing worse than getting a bill from the IRS after a year of being out of work!

How to Manage Your Money When You’re Unemployed?

CAREFULLY. Use discretion on every single penny leaving your posession. Take a hard look at your existing budget and go into ‘survival mode’ with your money. Cut the slack like take out coffee, subscription services, cable channels, gym memberships. That’s just for starters.

What Happens to My Health Care?

You will be offered COBRA most likely at your employers lower rates (not low though, shop around) and also ability to apply for insurance through unemployment benefits. Most large healthcare facilities in the US have staff that can assist you with filling out and applyig for reduced rate health insurance plans. These positions were funded by the government when they stopped funding the ‘free care’ a few years back. Call your existing provider and ask what susidized or income eligible plans they offer.

How do you save up money if you don’t have a job?

Yes Please! Save til it ouches. You truly don’t know how long you’ll be unemployed so make it a priority to continue to pinch pennies at every corner.

How do you budget if you are unemployed?

Carefully. Remember back in the days when you were starting your emergency fund? Start cutting the excess fat out now. Pay minimums on credit cards, talk to utility companies. Continue paying everyone just in a minimalist way until you get your new financial footing.

William Feather

A budget tells us what we can’t afford, but it doesn’t keep us from buying it.

Conclusion:

There are only two kinds of people on this earth when it comes to the workforce, those who are employed and those who are not. Sometimes becoming unemployed is expected and sometimes it comes as a complete surprise. Don’t be blindsided by an event that is entirely beyond your control. Good budgeting and money management before becoming unemployed is one of the best ways to be prepared and feel confident that you’ll get through these difficult times.

Mike Figgis

They call it a budget so you don’t budge from it.

Larry Dyson

Sometimes the best way to start saving money is simply to become more aware of your finances and spending habits.